FCPO

CRUDE PALM OIL FUTURES

WHAT IS FCPO

FCPO is a Ringgit Malaysia (MYR) denominated crude palm oil futures contract traded on Bursa Malaysia Derivatives, providing market participants with a global price benchmark for the Crude Palm Oil Market since October 1980 in the Commodity Futures Exchange space.

With an impressive track record of over 30 years, Bursa Malaysia Derivatives’ FCPO price has become the reference point for market players in the edible oils and fats industry.

contract size

Each FCPO Contract is

equivalent to 25 metric tons

settlement method

Physical delivery

maturity date

15th day of the spot month

Market trading hour

*1st session :

9PM – 11:30 PM (previous day)

2nd session :

10:30 AM – 12:30 PM

3rd session :

2:30 PM – 6:00 PM

*Only Monday to Thursday working day

contract specs

Global Access

FCPO is traded electronically

on CME Globex®, a global

electronic trading platform.

Accessing CME Globex® is

easy and allows individual and

professional traders anywhere

around the world to access

all Bursa Malaysia Derivatives’

products.

Manage Price Risk

Plantation companies,

refineries, exporters and millers

can use FCPO to manage risk

and hedge against the risk of

unfavourable price movement in

FCPO in the physical market.

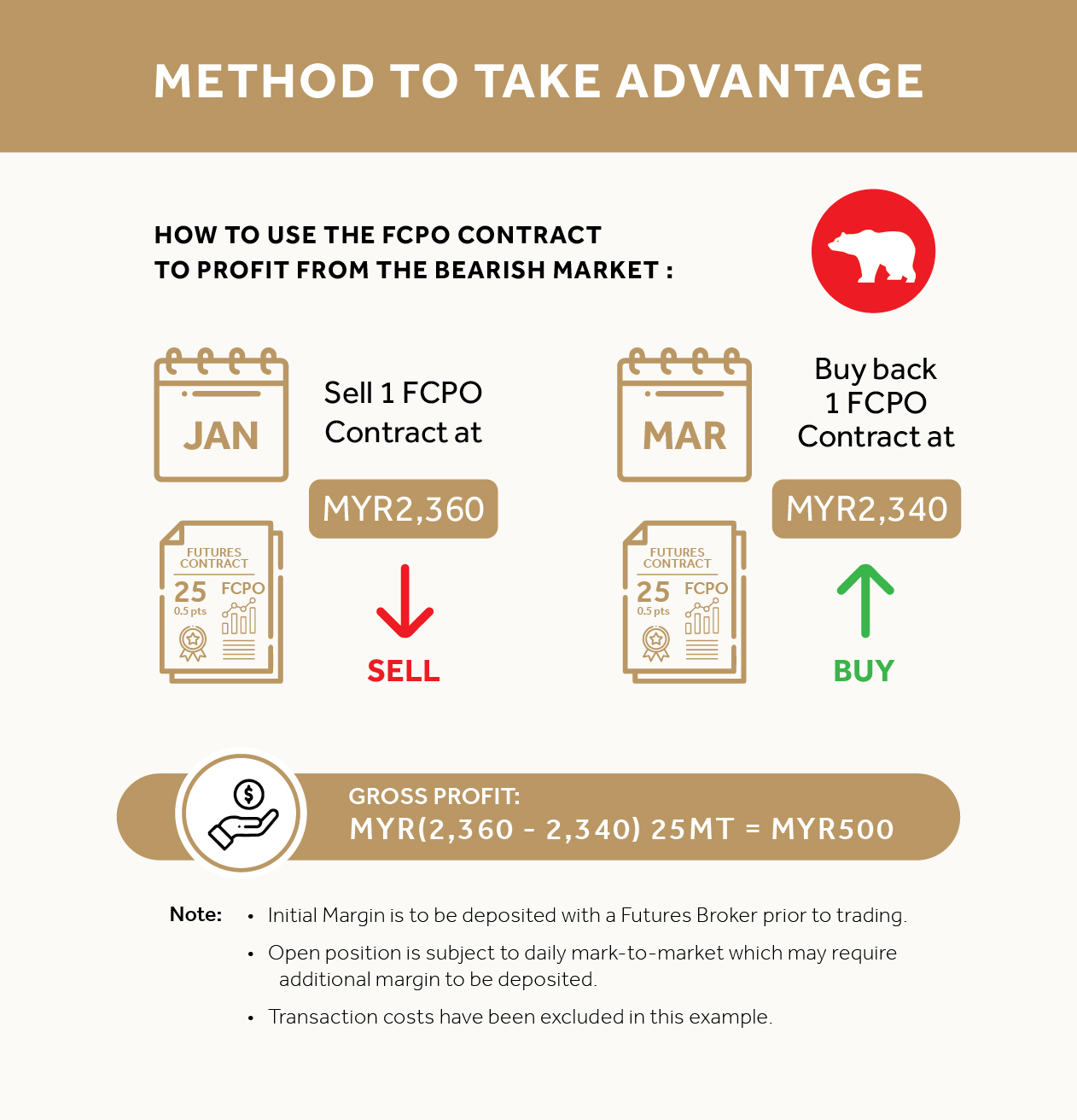

Bull and Bear Markets advantage

FCPO provides retail investors with a structured product to access the Crude Palm Oil market. Buy low and sell high for a bullish outlook on the movement of Crude Palm Oil prices, and vice versa for a bearish outlook.

Leveraged Trading

Gain leveraged exposure to the notional value of the underlying asset with a relatively small amount of capital (Initial Margin), magnifying the effect of a given change in price.

Immediate Market Exposure

Global fund managers, commodity trading advisers, and proprietary traders can gain immediate exposure to the active Crude Palm Oil market via FCPO.

Sustainable Physical Delivery

All physical deliveries of Crude Palm Oil (CPO) under the FCPO contract must be sourced from Palm Oil Mills that fulfil Oil Palm Management Certification (OPMC) under the Malaysian Sustainable Palm Oil (MSPO) Certification Scheme requirements.

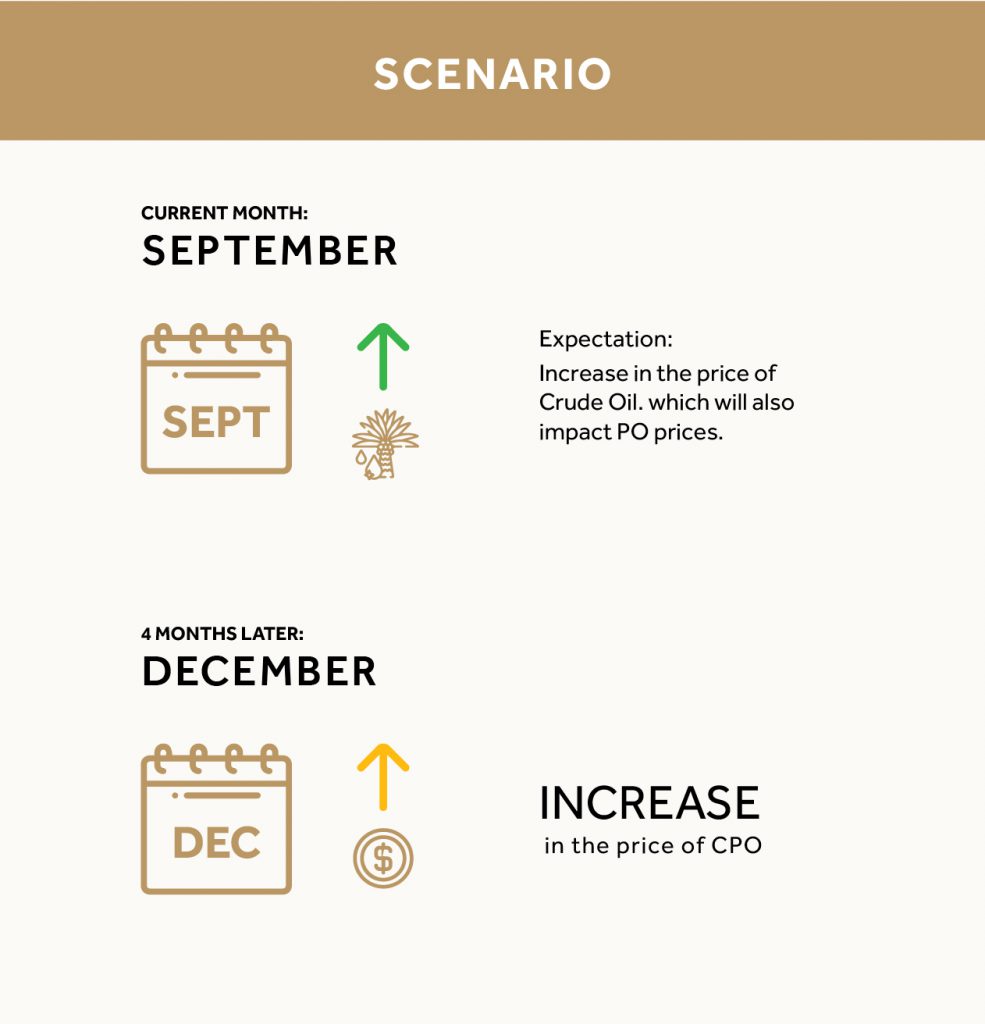

in bullish market scenario

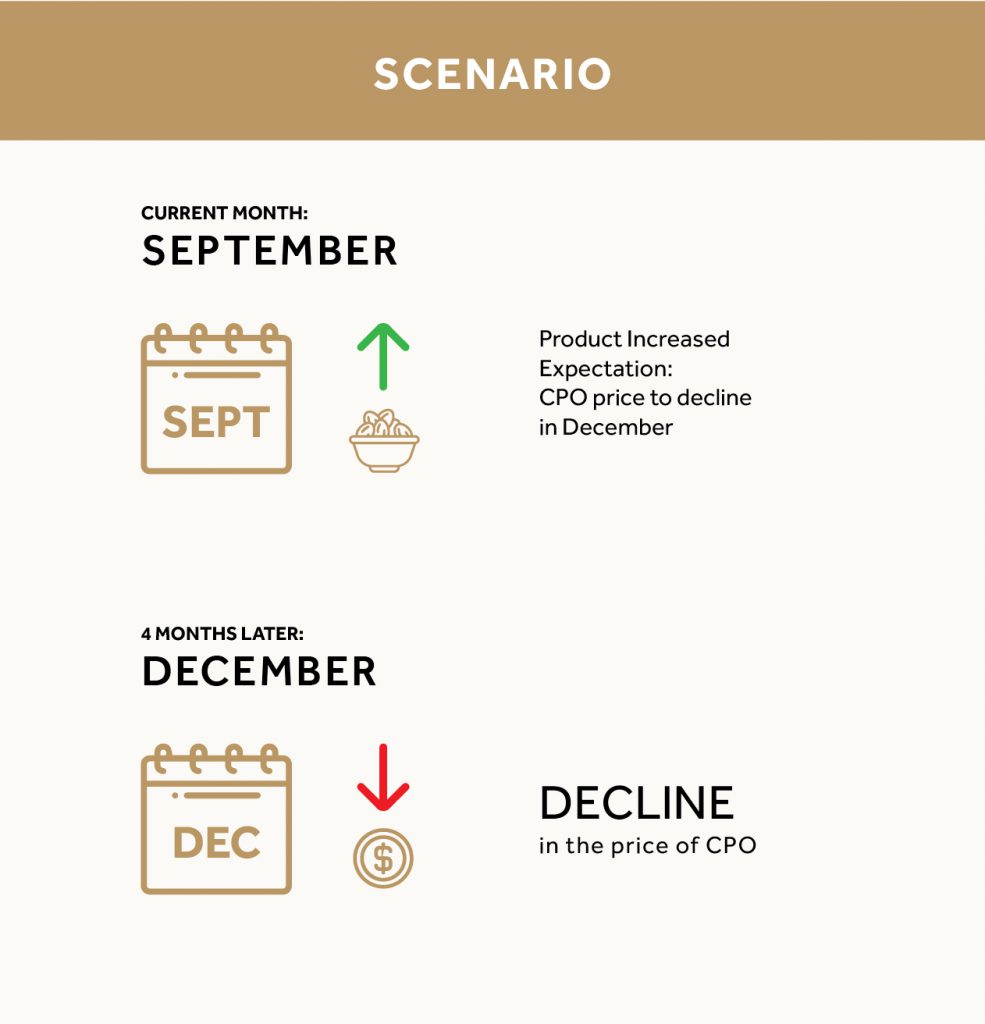

in bEARIsh market scenario

Contact us

-

TA Futures Sdn Bhd (340271-W)

32nd Floor, Menara TA One

22, Jalan P. Ramlee 50250,

Kuala Lumpur, Malaysia. - +603-2072 4832

- +603-2072 5001

- tafdealing@ta.com.my